Foreclosures and Bankruptcies Won’t Crash the Housing Market

If you’ve been following the news recently, you might have seen articles about an increase in foreclosures and bankruptcies. That could be making you feel uneasy, especially if you’re thinking about buying or selling a house.

But the truth is, even though the numbers are going up, the data shows the housing market isn’t headed for a crisis.

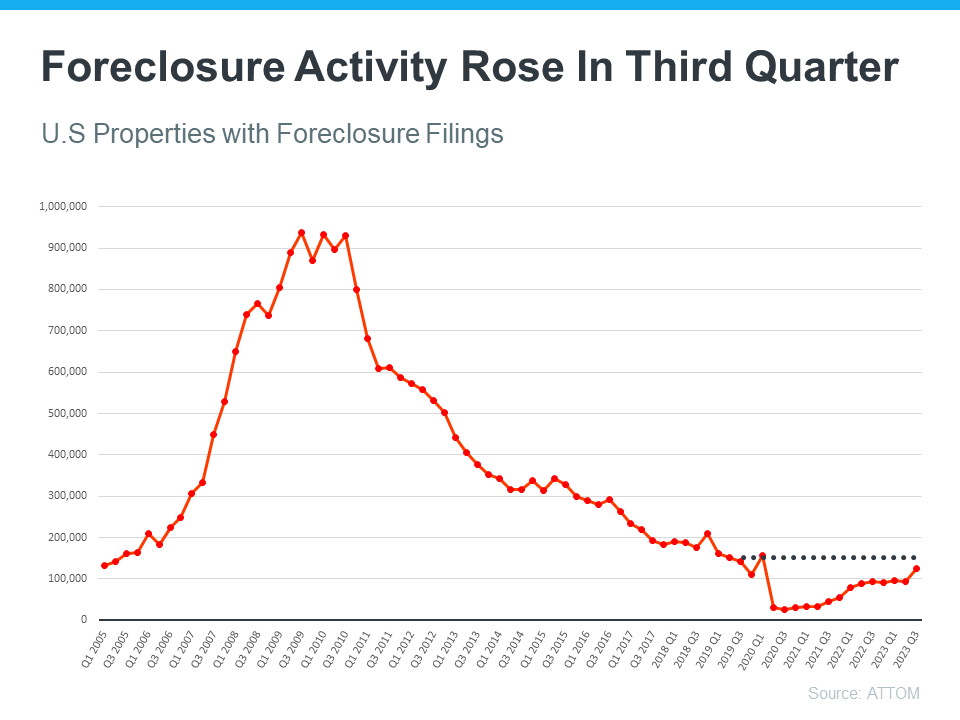

Foreclosure Activity Rising, but Less Than Headlines Suggest

In recent years, the number of foreclosures has been very low. That’s because, in 2020 and 2021, the forbearance program and other relief options were put in place to help many homeowners stay in their homes during that tough time.

When the moratorium ended, there was an expected rise in foreclosures. But just because they’re up, that doesn’t mean the housing market is in trouble.

To help you see how much things have changed since the housing crash in 2008, check out the graph below using research from ATTOM, a property data provider. It looks at properties with a foreclosure filing going all the way back to 2005 to show that there have been fewer foreclosures since the crash.

As you can see, foreclosure filings are inching back up to pre-pandemic numbers, but they’re still way lower than when the housing market crashed in 2008. And today, the tremendous amount of equity American homeowners have in their homes can help people sell and avoid foreclosure.

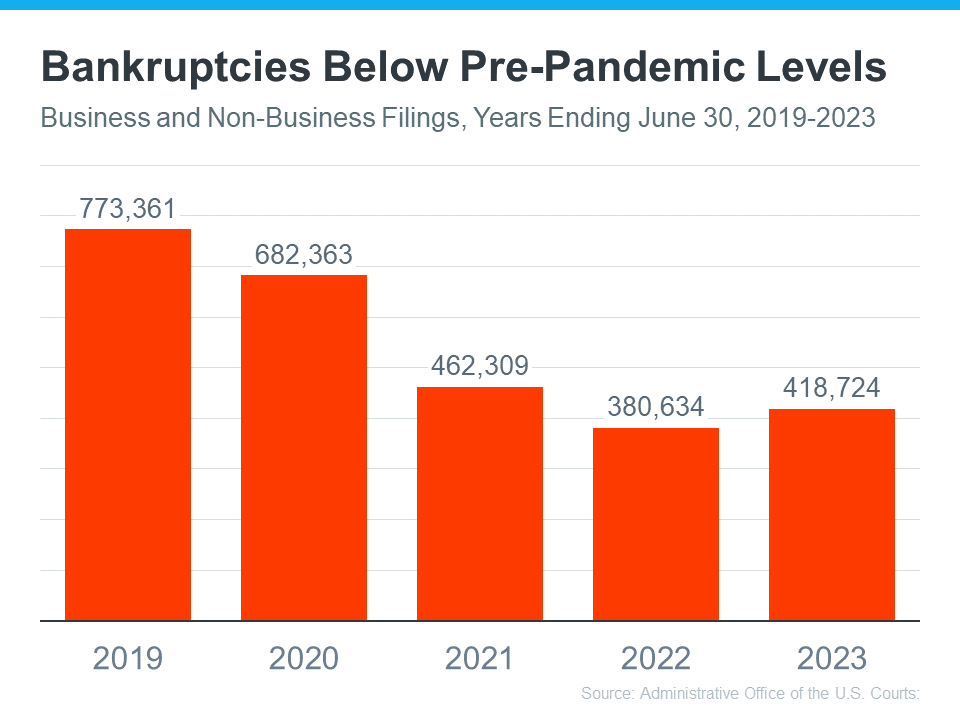

The Increase in Bankruptcies Isn’t Dramatic Either

As you can see below, the financial trouble many industries and small businesses felt during the pandemic didn’t cause a dramatic increase in bankruptcies. Still, the number of bankruptcies has gone up slightly since last year, nearly returning to 2021 levels. But that isn’t cause for alarm.

The numbers for 2021 and 2022 were lower than more typical years. That’s in part because the government provided trillions of dollars in aid to individuals and businesses during the pandemic. So, let’s instead focus on the bar for this year and compare it to the bar on the far left (2019). It shows the number of bankruptcies today is still nowhere near where it was before the pandemic. Both of these two factors are reasons why the housing market isn’t in danger of crashing.

Bottom Line

Right now, it’s crucial to understand the data. Foreclosures and bankruptcies are rising, but these leading indicators aren’t signaling trouble that would cause another crash.

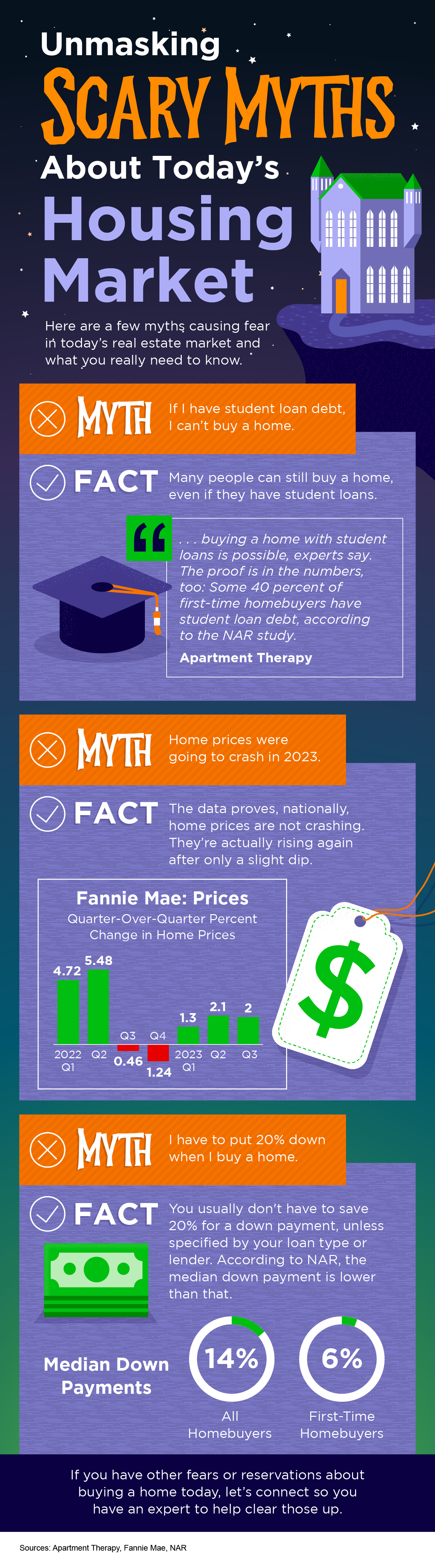

![Unmasking Scary Myths about Today’s Housing Market [INFOGRAPHIC] Simplifying The Market](https://files.keepingcurrentmatters.com/content/images/20231026/20231026-Unmasking-Scary-Myths-About-Todays-Housing-Market-KCM-Share.png)

![Key Terms To Know When Buying a Home [INFOGRAPHIC] Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2023/01/11165436/Key-Terms-To-Know-When-Buying-A-Home-KCM.png)

![Key Terms To Know When Buying a Home [INFOGRAPHIC] | Simplifying The Market](https://api.simplifyingthemarket.com/wp-content/uploads/2023/01/Key-Terms-To-Know-When-Buying-A-Home-MEM.png)

There’s no doubt today’s

There’s no doubt today’s